Logistic Other

Etihad to invest $10bn in new aircraft over five years

Etihad Airways is preparing for one of the most aggressive fleet expansions in its history, committing $10 billion to new aircraft over the next five years, all funded without tapping public markets.

Group CEO Antonoaldo Neves used the Dubai Airshow platform to spell out how the airline plans to reach 200 aircraft by 2030, a sizeable jump from its previous target of 170.

Neves made clear that the funding strategy is rooted in the carrier’s own performance. “If we talk about the capital deployment that we are going to have in the next five years, we are going to be investing $10 billion in new aircraft, or $2 billion per year,” he said. “We have another $37 billion coming from our own cash flow generation, so essentially it’s on us to finance our growth.”

IPO optional, not essential

With rumours circulating about a 2026 IPO, Neves addressed the question directly, without theatrics.

He confirmed the airline is technically ready to list but emphasised that the motivation simply isn’t there, “We are ready to go. We could go public anytime,” he said. “But that is not an objective function that we have as a management or as a board. When companies usually go public it is to finance growth. We don’t need that.”

For now, Abu Dhabi’s sovereign investor ADQ remains the sole shareholder, supported by a year that delivered 20% year-on-year growth and a 25% increase recorded in September.

Fleet strategy built around scale

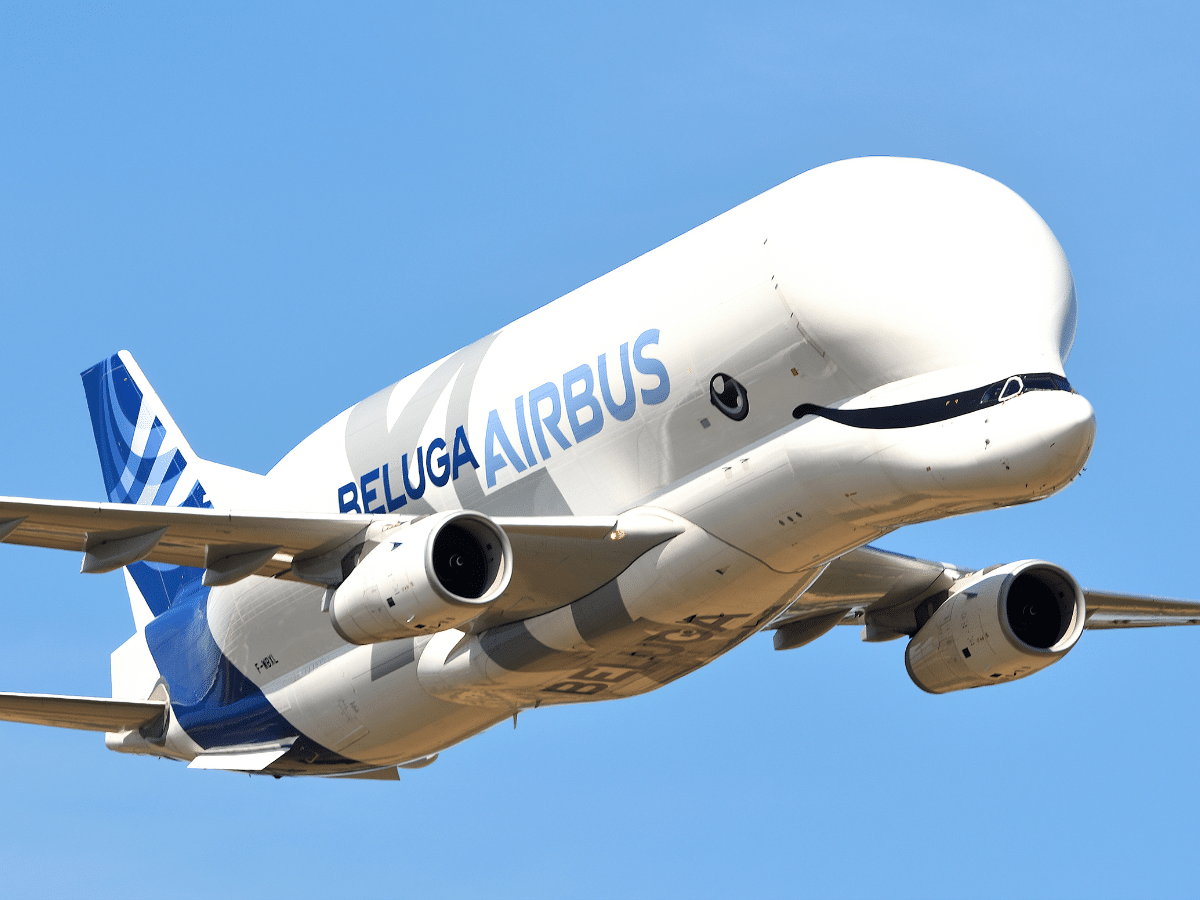

Etihad’s order book is thickening. The airline has already placed an order for 32 Airbus widebodies at the show, a mix of A330neos, A350-1000s and A350 freighters, following an earlier order of 28 Boeing widebodies this year.

Neves said the airline intends to induct around 20 new aircraft annually in 2025 and 2026, indicating an operational shift toward rapid-capacity ramp-up.

The declared path to 200 aircraft does more than raise headcount at the hangar. It suggests that Etihad sees sufficient underlying demand in Abu Dhabi’s hub strategy, the UAE’s broader tourism cycle, and intercontinental flows to justify adding widebodies at a pace usually associated with airlines twice its size.

A carrier with $37 billion in cash flow earmarked for growth is not positioning itself for consolidation or caution.

Etihad’s next chapter appears to hinge on scale, not as a speculative bet, but as a calculation rooted in demand visibility and an ownership structure willing to let the airline grow on its own terms.