Precious Metals

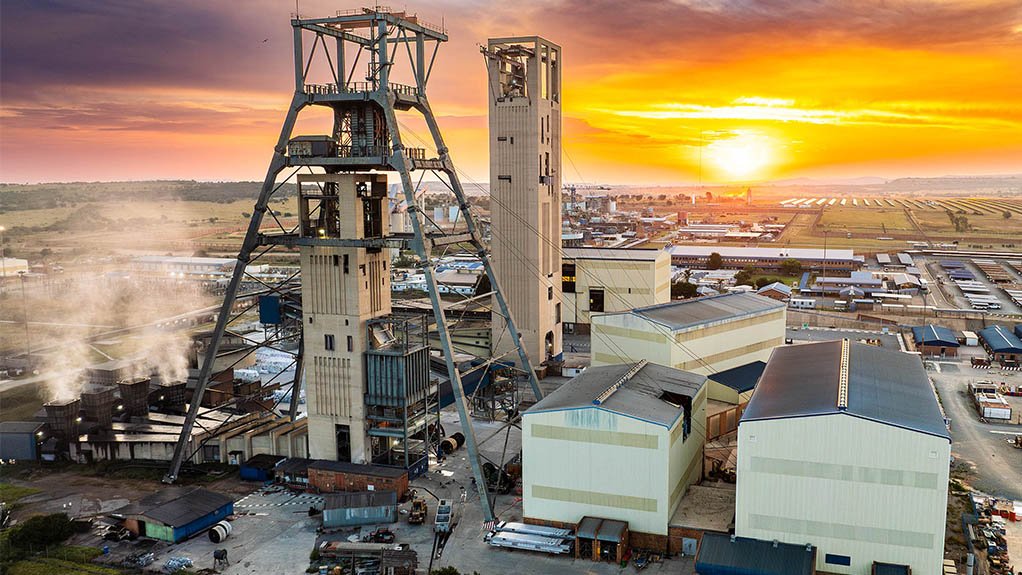

South Deep produces 24% more gold, on track to meet guidance, Gold Fields reports

The long-life mechanised South African mine, now in a much-improved position, remains on track to meet full-year 280 000 oz to 305 000 oz guidance.

Focus over the medium term remains delivery of safe, predictable production, incremental improvement and setting the foundations for long-term growth of the operation, Johannesburg- and New York-listed Gold Fields added.

South Deep’s all-in costs were a 10%-better $1 737/oz. First-quarter capital expenditure (capex) increased by 26% to R43-million on underground mobile equipment replacement and refurbishments and higher surface infrastructure maintenance.

Overall group gold production was 551 000 oz in a quarter in which production returned to more normalised levels amid all-in sustaining costs (AISC) at a 7%-lower $1 625/oz year-on-year and AIC $1 861/oz.

Gold Fields is on track to meet full-year guidance of between 2.250-million ounces and 2.450-million ounces. AISC is expected to be between $1 500/oz and $1 650/oz and AIC between $1 780/oz and $1 930/oz.

Group capex also remains unchanged, with total capex for the year expected to be between $1 490-million and $1 550-million. Sustaining capital is expected to be from $940-million to $970-million.

TWELVE-MONTH GHANA EXTENSION

Gold Fields has reached an agreement with Ghana for a way forward for the Damang mine following a rejection of its application to renew the Damang main mining lease in March. As part of this agreement, the government will, subject to parliamentary ratification this month, grant an extension of the lease to Gold Fields for 12 months from April.

During this period, Gold Fields will continue to process stockpiles and concurrently recommence opencast mining, subject to obtaining the requisite approvals.

“We’ll also progress and finalise the detailed bankable feasibility study to extend the life of Damang mine, including undertaking the required infill drilling to improve confidence in the mineral resources,” the company stated in a release to Mining Weekly.

Gold Fields has support for continuing to operate at Tarkwa, where preparation has begun for the application to extend the Tarkwa mine leases, which are due for renewal in 2027.

Requisite approvals are also being sought for the proposed joint venture between Gold Fields and AngloGold Ashanti on the neighbouring Tarkwa and Iduapriem mines.

RAMPING-UP IN CHILE

Salares Norte in Chile produced a 13%-higher 50 000 oz gold equivalent and the process plant is being prepared to operate through the winters. To further mitigate the risk of freezing in the plant, additional heat tracing is being installed. Numerous simulation exercises and plant shutdowns have been undertaken to fine-tune operational procedures should an extreme weather event occur.

Salares Norte’s guidance remains unchanged, with 2025 gold equivalent production expected to be between 325 000 oz gold equivalent and 375 000 oz gold equivalent at an AISC of $975/oz gold equivalent to $1 125/oz gold equivalent, and 2026 set to be the first full year of steady-state production.

Extensive exploration drilling is under way to identify life extension opportunities at Salares Norte and Gold Fields has budgeted $23-million on exploration drilling and greenfield activities in the area for 2025.

WINDFALL PROJECT

The focus at Canada’s Windfall project during the first three months of this year remained on progressing the permitting process, with the aim of obtaining the required environmental approvals during the second half of this year to support full-scale construction and mining.

The team also advanced the engineering work required ahead of a final investment decision expected in the first quarter of next year. In addition, engagements for the execution of an Impact Benefit Agreement with the Cree First Nation of Waswanipi and the Cree Nation government continued during the quarter.