Energy Other

Gas and Geopolitics in the Eastern Mediterranean

Initial Promise & Geopolitical Ambitions

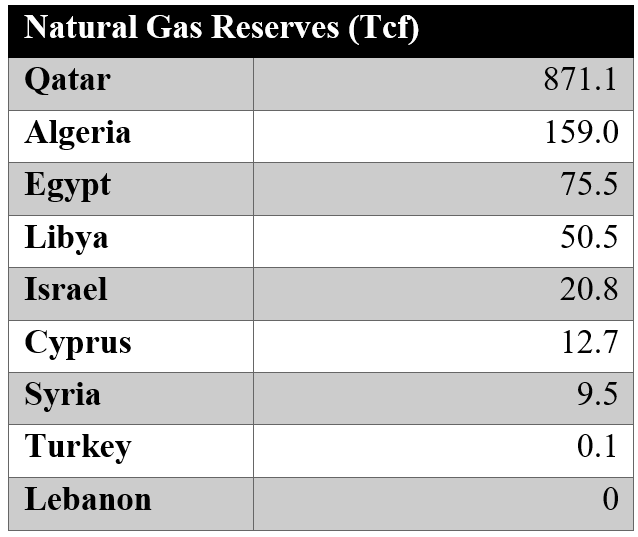

The discovery of natural gas in the Eastern Mediterranean after 1999 created significant excitement for three main reasons. Its proximity to the EU offered a potential alternative to Russian gas supplies. Israel's transformation into a net exporter provided a tool for regional economic integration. The gas was also seen as a catalyst to resolve long-standing disputes, particularly over maritime boundaries and the division of Cyprus.

Measured Successes in Development and Diplomacy

In practical terms, the region's gas development has seen notable successes. Approximately 80 trillion cubic feet of reserves have been discovered, with Egypt and Israel becoming significant producers. Their LNG exports have been crucial in helping cover the EU's energy shortfalls after the reduction of Russian gas. Diplomatically, a US-brokered agreement successfully demarcated the maritime boundary between Lebanon and Israel.

Persistent Regional Conflicts & Limitations

Despite these successes, the initial hope that gas would foster regional peace has proven largely naive. Ongoing conflicts, including Israel's wars in Gaza and Lebanon and Houthi attacks on shipping, have heightened instability. Crucially, the envisioned undersea pipeline to the EU has failed to secure financing and is considered a dead project, limiting export routes.

Egypt's Central yet Challenged Role

Egypt functions as the region's indispensable gas hub, being the only country with LNG export facilities. However, its role is challenged by soaring domestic demand, which often diverts gas from exports and has even made Egypt a seasonal net importer. Further complications include production problems at its massive Zohr field and regional conflicts that periodically disrupt gas imports from Israel.

Israel's Export Constraints and Focus

Israel has rapidly become the region's second-largest gas producer, exporting nearly half of its output. Geopolitical and infrastructural barriers, however, have stranded its gas within the region, preventing access to higher-priced European markets. Consequently, Israel has focused on expanding pipeline exports to immediate neighbors, recently signing a deal to double gas deliveries to Egypt.

The Cyprus Stalemate

Cyprus holds promising gas discoveries but development is stalled by the island's political partition and maritime disputes with Turkey. These geopolitical tensions, combined with the high cost of developing deepwater fields far from shore, have deterred major investment. Like Israel, Cyprus's most likely export path is also via Egypt's LNG terminals, creating a regional dependency.

Turkey's Disruptive Influence

Turkey is a key powerbroker, largely through its ability to block regional projects. Its extensive pipeline and LNG infrastructure gives it leverage, but its exclusion from the Eastern Mediterranean Gas Forum and ongoing disputes with Cyprus and Greece hinder cooperation. Turkey's actions, including sending drilling ships into contested waters, have directly disrupted exploration efforts near Cyprus.

Lebanon and Syria's Unrealized Potential

Lebanon's maritime boundary deal with Israel was a diplomatic breakthrough, allowing it to begin offshore exploration. However, subsequent drilling found no commercial gas, and investor interest has evaporated amid regional conflict. Syria's energy sector is decimated by civil war, and its offshore potential remains entirely unexplored, leaving it unable to participate in the regional gas trade.

Conclusion: Modest Gains Amidst Intractable Conflicts

The overall impact of Eastern Mediterranean gas has been more modest than initially hoped. While enabling some cooperation, it has proven insufficient to overcome the region's deep-rooted political and territorial conflicts. The primary strategic value of the gas remains its proximity to the EU market, but its development continues to be hampered by investor risk and persistent regional instability.