Energy Other

Energy Powerhouses, a High-Tech Israel, and the Next Wave of Diversification

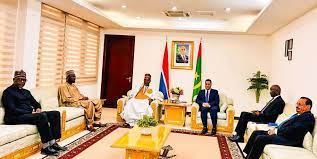

The global economic landscape is expected to see slower growth in 2025, yet the Middle East and North Africa (MENA) region is poised for a gradual re-acceleration. This momentum is fueled by normalized oil supply, robust non-oil sectors in the Gulf, and ongoing reform programs in economies like Egypt. While the region is projected to expand, its outlook remains tempered by significant downside risks, including geopolitical tensions, shipping disruptions, and volatile commodity prices.

The Gulf powerhouses are central to this positive trajectory. Saudi Arabia is aggressively advancing its Vision 2030, channeling sovereign wealth into giga-projects and new sectors, while the UAE stands as a regional benchmark for diversification with non-oil activities now dominating its GDP. Qatar’s strategy is firmly anchored to its massive LNG expansion, which ensures long-term revenue visibility. Beyond hydrocarbons, key sectors like trade, logistics, tourism, and real estate are driving growth, supported by the vast financial firepower of sovereign wealth funds that provide a critical buffer and accelerate domestic transformation.

Israel represents a distinct and resilient economic model within the region, defined by a high-tech sector that accounts for a major share of its GDP and exports. Despite recent shocks, its foundational strengths—deep human capital and global venture connectivity—remain intact, supporting a projected re-acceleration. In the wider neighborhood, economies like Egypt and Türkiye are navigating complex challenges, with their prospects hinging on the success of IMF-backed reforms and macroeconomic re-balancing efforts, respectively.

Overall, the MENA region's 2025 outlook is powered by a dual-engine model: the enduring financial scale of hydrocarbons and the emerging potential of innovation ecosystems. However, this positive trajectory faces material risks, including geopolitical escalations that could disrupt trade, oil price volatility that impacts fiscal balances, and significant execution risk on the ambitious megaprojects that are central to the region's diversification plans.