Energy Markets

Top 6 Liquefied Natural Gas Companies in Global 2025 Global Growth Insights

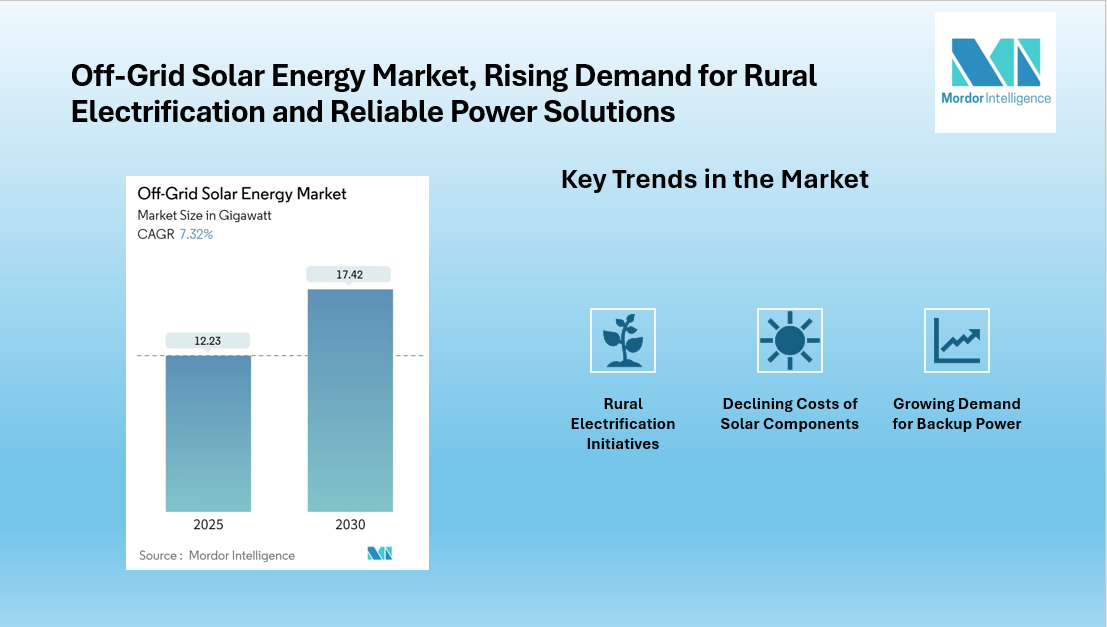

Market Growth and Drivers

The global Liquefied Natural Gas (LNG) market is on a steady growth trajectory, valued at USD 0.21 billion in 2025 and projected to reach USD 0.39 billion by 2034. This expansion, at a CAGR of 7.13%, is fueled by its role as a cleaner-burning transition fuel, supporting global decarbonization, industrial growth, and energy security as nations shift away from coal and oil.

Regional Demand Dynamics

Demand is heavily concentrated in the Asia-Pacific region, which accounts for 65-67% of global LNG imports, led by China, Japan, India, and South Korea. Europe is another critical market, with imports rising over 60% between 2022-2024 as the region diversifies its energy sources away from Russian pipeline gas, reinforcing LNG's strategic importance.

Dominant Supply-Side Players

On the supply side, the market is dominated by a few key countries and corporations. Qatar (21%), the United States (20%), and Australia (15%) are the top LNG producers. Major integrated energy companies like Royal Dutch Shell, Exxon Mobil, and Chevron control a significant portion of the global supply chain, from production to shipping and trading.

The US Market Expansion

The United States has emerged as a top LNG exporter, with its capacity exceeding 90 million tonnes per annum (MTPA) in 2024. This rapid growth, driven by abundant shale gas, is centered on Gulf Coast terminals like Sabine Pass and Corpus Christi, with ongoing expansion projects solidifying its long-term leadership and feeding demand from both Europe and Asia.

Industrial and Environmental Applications

LNG is vital for power generation and heavy industries like petrochemicals, fertilizers, and steel. Its environmental appeal lies in emitting 20-30% less CO₂ than oil and nearly 40% less than coal. The marine sector is also a fast-growing consumer, with LNG bunkering volumes rising 40% from 2021-2024 as shippers comply with stricter emissions regulations.

| Country | Share of LNG Manufacturers (2025) | Key Highlights |

|---|---|---|

| Qatar | 21% | Largest LNG producer; expanding North Field projects to increase global supply significantly. |

| United States | 20% | Fastest-growing LNG exporter; >90 MTPA capacity across major Gulf Coast terminals. |

| Australia | 15% | Massive LNG output with major projects in Western Australia and Queensland. |

| Russia | 10% | Sizable LNG capacity supported by Yamal and Arctic LNG developments. |

| Malaysia | 6% | Established LNG exporter with strong Petronas-led operations. |

| Nigeria | 5% | Africa’s largest LNG producer; NLNG trains support expanding West African LNG trade. |

| Indonesia | 4% | Significant Asia-Pacific LNG supplier with both onshore and offshore facilities. |

| Norway | 3% | Key European LNG producer; strong focus on sustainable LNG for marine fuel. |

| Trinidad & Tobago | 3% | Major Caribbean LNG exporter with strategic supply routes to the Americas. |

| Others | 13% | Includes Mozambique, Canada, UAE, Oman, and emerging Asian & African LNG hubs. |

Technological and Infrastructural Advancements

The industry is being reshaped by technological innovations, including Floating LNG (FLNG) units that enable offshore liquefaction and small-scale LNG solutions for remote markets. Digitization, through AI and predictive maintenance, is optimizing the entire supply chain. The global LNG carrier fleet has surpassed 750 vessels to support this growing trade.

Focus on Sustainability and Low-Carbon LNG

A major trend is the push for sustainability. Leading companies are investing in carbon capture and storage (CCS) and methane reduction technologies. The market for "carbon-neutral LNG," where emissions are offset, is growing, driven by demand from environmentally conscious buyers in Europe and Asia.

| Company | Headquarters | CAGR (Estimated) | Past-Year Revenue (Estimated) | Geographic Presence | Key Highlight | |

|---|---|---|---|---|---|---|

| British Petroleum PLC (BP) | London, United Kingdom | 4.8% | USD 227 billion | Global (Europe, North America, Asia-Pacific, Middle East) | Major LNG trader with expanding LNG portfolio and long-term supply contracts across Asia. | |

| Chevron Corporation | California, USA | 5.2% | USD 196 billion | North America, Asia-Pacific, Middle East, Africa | Key LNG producer with Gorgon and Wheatstone LNG projects driving APAC export capacity. | |

| Gazprom Group | Moscow, Russia | 3.7% | USD 140 billion | Europe, Asia, Russia, Middle East | Major LNG supplier with Yamal LNG and expanding Arctic LNG capacity. | |

| Equinor ASA | Stavanger, Norway | 4.1% | USD 115 billion | Europe, USA, Middle East, Asia | Strong producer of sustainable LNG; major supplier to European energy markets. | |

| Royal Dutch Shell PLC | London, United Kingdom | 5.5% | USD 323 billion | Global (Europe, Asia-Pacific, Africa, Middle East, Americas) | World’s largest LNG portfolio with integrated operations from upstream to shipping. | |

| Exxon Mobil Corporation | Texas, USA | 4.9% | USD 344 billion | Global (North America, Asia-Pacific, Middle East, Europe) | Leading LNG producer with major involvement in Qatar LNG and Papua New Guinea LNG projects. |

Opportunities for New Entrants

This transformation creates opportunities for startups and emerging players. Key niches include developing digital platforms for supply chain optimization, providing small-scale LNG solutions, establishing LNG bunkering services, and creating technologies that support the production of low-carbon and renewable-integrated hydrogen.