Energy Markets

Solar Panel Recycling Market Outlook Report 2026-2034

Market Growth and Drivers

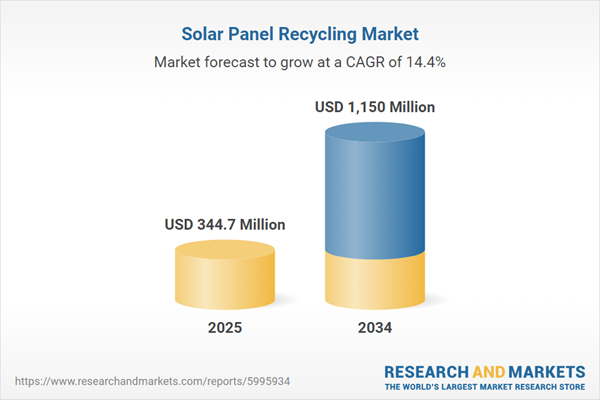

The global solar panel recycling market is poised for significant expansion, valued at $344.7 million in 2025 and projected to reach $1.15 billion by 2034, growing at a 14.4% CAGR. This growth is driven by an increasing volume of decommissioned panels from aging installations, weather damage, and stringent regulatory frameworks like Extended Producer Responsibility (EPR) schemes. Corporate commitments to circular economy principles further accelerate market development, creating a robust foundation for the industry's future.

Key Opportunities and Regional Focus

Significant market opportunities lie in leveraging the growing inflow of end-of-life panels, enhancing recyclability through design innovations, and developing hybrid processes to improve material recovery yields. Regionally, opportunities vary: Europe emphasizes regulatory compliance, Asia-Pacific focuses on scaling logistics networks, and the Middle East & Africa address environmental management. Strategic partnerships and advanced recovery technologies are crucial for capturing high-purity material streams and optimizing cost structures.

Technological and Process Innovations

The market is witnessing important trends in process optimization, including solvent-lean EVA/POE removal, AI-assisted identification at material recovery facilities, and digital serial traceability. Hybrid processes combining mechanical separation with targeted thermal or chemical treatments are proving most effective for balancing capital expenditure and recovery purity. These innovations are particularly beneficial for thin-film recycling, which benefits from higher intrinsic material value and established closed-loop programs.

Competitive Landscape and Economic Factors

The competitive field comprises specialized PV recyclers, waste management majors, glass and metals processors, and OEM/EPC consortia piloting take-back programs. Market economics depend heavily on scale, local logistics efficiency, purity premiums on recovered materials like glass and metals, and compliance costs. Companies offering certified chains of custody, high recovery yields, and integrated services from field removal to verified material resale are gaining competitive advantage.

Challenges and Future Outlook

Despite growth prospects, the industry faces persistent challenges including EVA debonding energy consumption, black-mass variability, fluoropolymer backsheet processing, and safety concerns. Standards for secondary-material quality and field logistics costs also present hurdles. As decommissioning accelerates, the market is evolving toward more sophisticated solutions that prioritize certified recycling processes, low-impact technologies, and comprehensive service offerings that support the entire solar value chain.