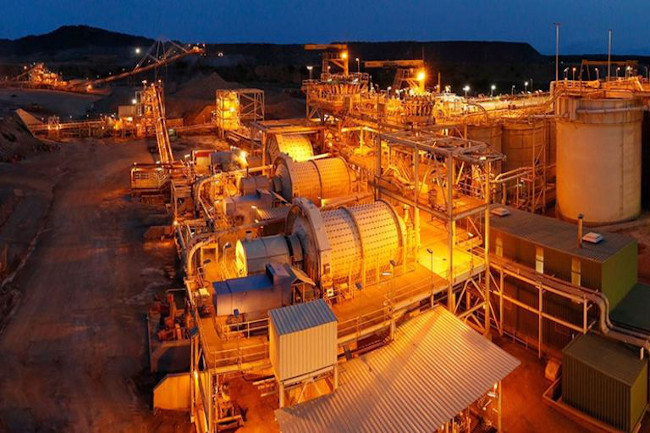

Mining Other

Mining sector growth outperforms other sectors again, but Minerals Council notes economic stagnation

The Minerals Council says this marks the twelfth consecutive quarter in which economic growth has remained below 1%. Between 2014 and 2024, yearly average real GDP growth was 0.8%, compared with population growth of 1.3%.

“In per capita terms, South Africans have, on average, become poorer as population growth has consistently outpaced real economic growth,” it says.

On a more positive note, the mining sector recorded the strongest growth among all key sectors for the second consecutive quarter, expanding by 2.3% quarter-on-quarter in the third quarter, after a 3.5% increase in the second quarter.

The Minerals Council says the positive mining results were supported by platinum group metals (PGMs), manganese ore and coal.

On the expenditure approach to GDP, the Minerals Council says the external trade balance was once again a drag on the economy in the third quarter, with net exports of goods and services subtracting 0.4 percentage points from the GDP print.

Exports of goods and services increased by 0.7% quarter‐on‐quarter, compared with a 2.2% increase in imports.

Mineral exports were R18-billion higher for January to September this year, compared with the same period in 2024. The council says this was mainly on the back of higher gold and PGM prices.

On the income approach to GDP (nominal), gross operating surplus, a proxy for profits, rose by 6.9% year‐on‐year to R883.7-billion in the third quarter, while compensation of employees increased by 3.2% to R869-billion.

In the mining sector, after contracting for three consecutive quarters, the gross operating surplus in the third quarter surged by 21.3% year‐on‐year to R80.5-billion, while compensation of employees grew by 2.1% to R47.5-billion.

The Minerals Council says the bottom line is that between 1994 and 2008, South Africa accounted for 0.8% of the global economy. Since the Global Financial Crisis of 2008 to 2009, it notes that South Africa’s share of global GDP has gradually declined.

By 2024, the country’s share had dropped to 0.5%.

The Minerals Council said it computed the implications of this decline and the opportunity cost for South Africa, noting that in 2024, GDP (nominal) would have been R18.3-trillion instead of R7.4-trillion; and tax revenue would have amounted to R4.6-trillion in 2024 instead of the R1.8-trillion that was collected.

“Poor economic growth has thus come at a high cost to the economy and the taxpayer. Our position as the Minerals Council is that the mining sector, as well as construction, can catalyse growth.

“It is essential that South Africa develops investor-friendly policies and an operating environment to attract capital inflows into these sectors as a matter of urgency,” it argues.

Similarly, the Minerals Council adds that mechanisms to address South Africa’s globally uncompetitive electricity prices must be quickly formulated.

It notes that, in the mining sector, ferroalloy smelters are no longer competitive despite the abundance of minerals in the country.

It notes that the ferrochrome sector is on the brink of closing all smelters because of the more than 900% increase in electricity prices for large consumers since 2008.

“The ramifications for domestic industries both supplying the smelters and relying on their products are serious, with negative consequences for employment.

“While economic theory underscores the importance of strong institutions in driving growth, institutional reforms in South Africa have been lacklustre.

“In addition, critical microeconomic reforms – such as those targeting the labour market and competition – remain overdue,” says the Minerals Council.