Mining Other

Kenmare confident of meeting full-year guidance, but warns of demand pressures

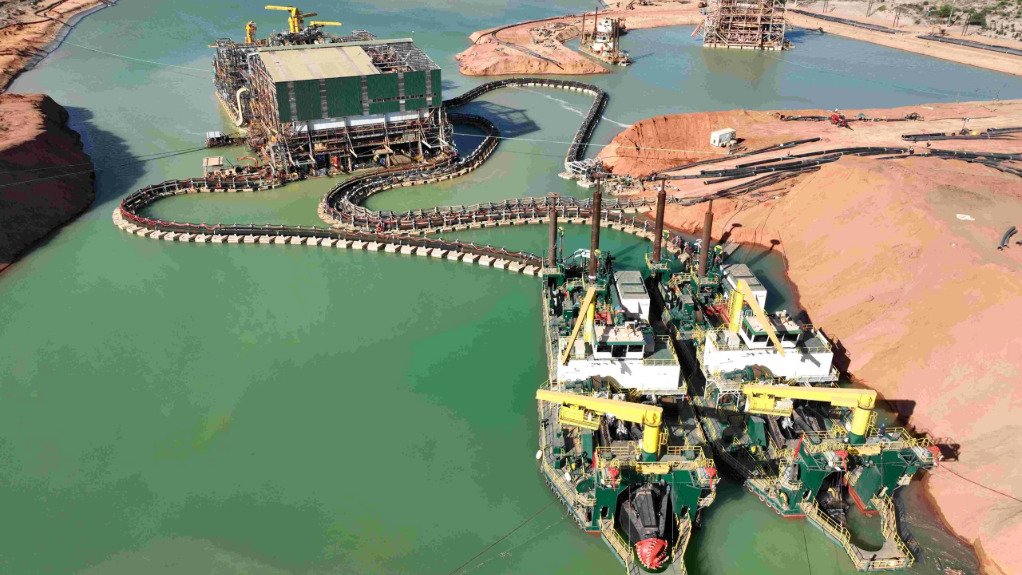

For the third quarter, ended September 30, Kenmare produced 298 400 t of heavy minerals concentrate (HMC) – a 16% year-on-year decrease, mainly owing to a 19% decrease in excavated ore volumes related to the scheduled production pause at the Wet Concentrator Plant (WCP) A, but benefitting from a 6% increase in ore grades.

WCP A is Kenmare's largest mining plant. The company has been upgrading the plant ahead of its planned move to the Nataka orezone – an area COO Ben Baxter has previously described as being key to the Moma mine's future, as its holds about 70% of the Moma mineral resources.

WCP A will continue to ramp up production in the quarter to end December 31 and will complete its mine path in Namalope in the second quarter of 2026. The plant will begin its transition to Nataka from late in the second quarter of 2026, which is expected to take about 18 months.

WCP A will mine in Nataka for the remainder of its economic life, which is expected to exceed 20 years.

Meanwhile, as a result of a 21% year-on-year decrease in HMC processed to 282 800 t for the third quarter, ilmenite production decreased by 19% year-on-year to 209 000 t, primary zircon output decreased by 16% year-on-year to 12 300 t and rutile output fell by 38% year-on-year to 1 800 t.

Concentrates production of 21 300 t was, however 58% higher year-on-year, benefitting from the first commercial shipment of ZrTi – a tailings product.

Kenmare also points out that its shipments for the third quarter were down 25% year-on-year at 227 400 t, as a result of the Moma mine having operated at 50% of its shipping capacity while one of its two transshipment vessels, the Peg, was undergoing maintenance work in its five-yearly dry dock, and returned in late September.

Kenmare's other transshipment vessel, the Bronagh J, however, delivered a strong performance in the third quarter.

The company had also been exploring an opportunity to rent a third transshipment vessel to supplement shipment capacity over the coming months but, owing to lower short-term demand, the hiring of a third transshipment vessel has been deferred. The hiring of a third vessel, however, remains under consideration for next year.

"Global market conditions remain challenging and one of Kenmare’s customers has indicated that it will be unable to take its contracted volumes in the fourth quarter. Besides this, demand for our products remains in line with expectations, with strong, high-value zircon sales volumes expected in the fourth quarter.” says MD Tom Hickey.

Kenmare states that demand for mineral sands products globally had softened in the third quarter, with prices having weakened compared with the second quarter.

"Weaker global demand for titanium minerals reflected softer underlying end markets, such as housing and construction, and this continues to weigh on titanium dioxide pigment consumption," it notes.

It adds that elevated pigment inventories across the pigment supply chain led to pigment producers reducing production, limiting demand for titanium feedstocks, particularly in China. Pigment inventories in China gradually decreased throughout the summer months and, consequently, Chinese pigment production and prices have increased in recent weeks after inventories normalised. Demand for titanium sponge, which is used to make titanium metal, remained relatively stable throughout the quarter.

Supply of titanium feedstocks continues to exceed demand, negatively impacting market pricing and putting pressure on producers. Domestic Chinese ilmenite production and imports of concentrates remain the largest sources of new supply. Several major producers are understood to be moderating production, however there is less visibility on the response from the small-scale concentrates producers.

Kenmare says the zircon market remained subdued in the third quarter, with limited recovery in end-market demand.

"In China, increased supply of lower-quality zircon contained in concentrates, combined with a greater willingness among some customers to accept these products, has negatively impacted prices for zircon. However, demand for Kenmare’s high-grade zircon remained stable in China and Europe and the Company continues to expect to sell all of its 2025 zircon production and to finish the year with low zircon inventories," it adds.

Implementation agreement

Kenmare has also warned shareholders that it remains concerned about the prolonged renewal process of its implementation agreement with the government of Mozambique. The agreement governs the terms under which the company conducts mineral processing and export activities, but does not impact on mining operations at Moma, which are conducted under a separate regulatory framework.

The implementation agreement's original expiry date was December 21, 2024, but Kenmare says the Mozambique Ministry of Industry and Commerce has provided confirmation that Kenmare’s existing rights and benefits remain in full force and effect pending conclusion of the extension process.

Kenmare points out that Hickey had met with the Mozambique Minister for Mineral Resources and Energy in the third quarter to discuss the matter.