Storage

How MENA’s $100 billion bet is redefining energy logistics

The Middle East’s next great export revolution may not flow from oil wells or LNG terminals, but from vast solar fields and wind farms generating the clean fuel of the future: hydrogen. Across the MENA region, governments are investing more than $100 billion in large-scale hydrogen and ammonia projects, betting that the molecule could underpin a new global energy system.

According to the MENA Energy Outlook 2025, Oman, Egypt, Saudi Arabia, and Mauritania are leading a wave of projects that could turn the region into a hydrogen export powerhouse within the next decade. These ambitions reach far beyond energy, creating opportunities across port infrastructure, shipping, storage, and supply-chain services.

As the region diversifies away from hydrocarbons, a central question looms: Can MENA transform its hydrogen ambitions into a tangible, trade-ready export system, and in doing so, redefine global logistics?

Mapping the Hydrogen Landscape

Hydrogen comes in many shades. “Green” hydrogen is produced using renewable energy to split water molecules, “blue” hydrogen is derived from natural gas with carbon capture, and “white” or “gold” hydrogen occurs naturally underground. Each has a role in the region’s transition strategy.

Across MENA, more than 130 hydrogen projects are underway or proposed across 14 countries. Egypt leads the count with 34 active schemes, followed by Oman with 23, the UAE with 21, and Morocco and Mauritania with 17 and 10 respectively. While North Africa holds the numerical edge, the GCC provides the financial muscle and technological capacity to bring these plans to life.

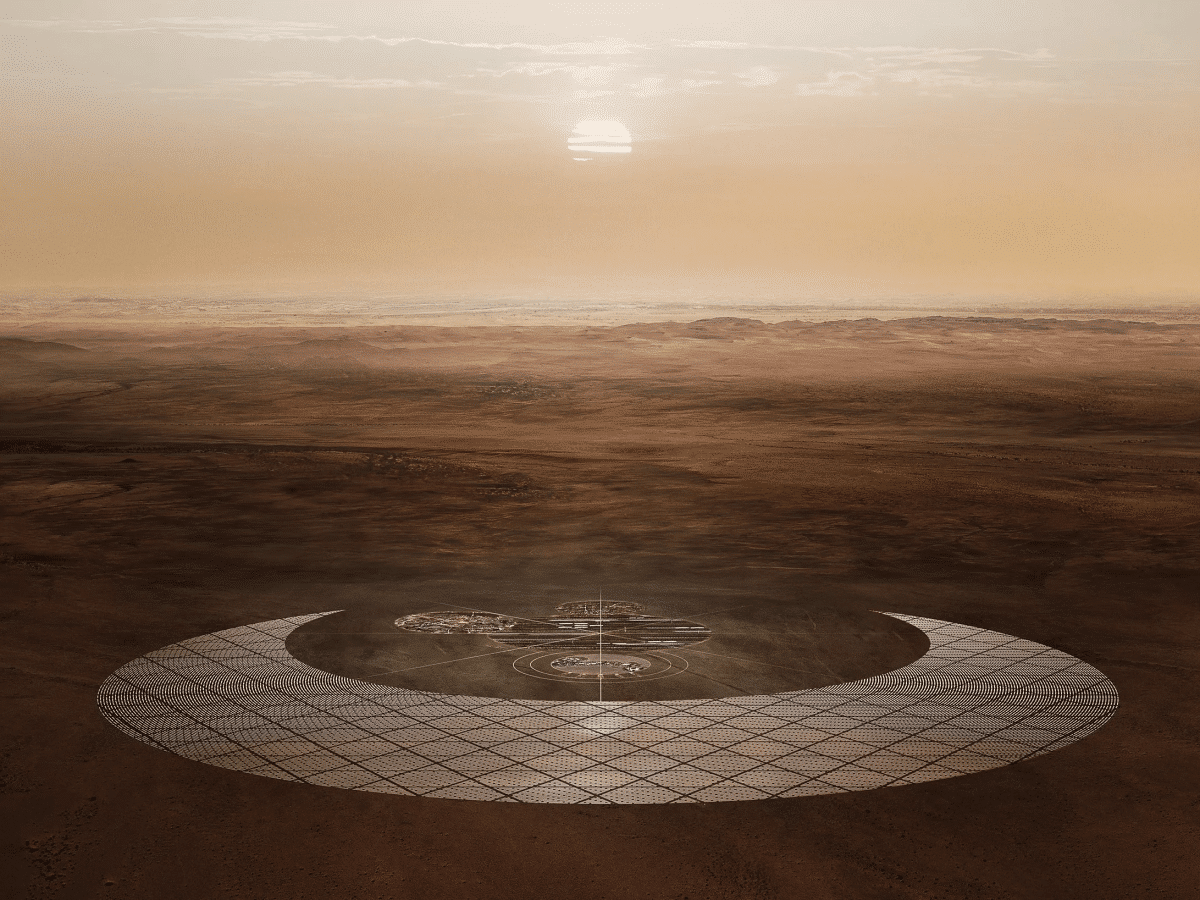

Among the flagship projects, Oman’s state-owned Hydrom has signed $52 billion worth of agreements for six green hydrogen developments involving 15GW of renewable capacity. Egypt’s Ain Sokhna region is fast becoming a green-energy cluster, with $30 billion in planned investments under the Suez Canal Economic Zone (SCZONE). Saudi Arabia’s Neom Green Hydrogen Company, a 2.2GW facility slated to come online in 2026, will produce 1.2 million tonnes of green ammonia annually, entirely for export. Mauritania’s Megaton Moon Project, one of the most ambitious in the world, plans 60GW of wind and solar generation to create 4 million tonnes of hydrogen for conversion into ammonia.

Together, these ventures mark the emergence of a new industrial map for the region, one centred around renewable hubs, coastal ports, and long-distance logistics.

Why Hydrogen Matters for Logistics

As MENA economies move to export low-carbon fuels, the infrastructure demands are profound: massive storage tanks, new port terminals, specialised pipelines, and fleets of ships capable of carrying liquefied hydrogen or its derivatives such as ammonia and methanol.

The Energy Outlook 2025 notes that hydrogen use in refining, ammonia, and methanol production already accounts for most of the Middle East’s domestic demand, and is expanding rapidly. To export at scale, the region will need to replicate its oil-era logistics leadership, this time built on digital, decarbonised networks.

Ports such as Sohar, Duqm, NEOM, and Jebel Ali are already positioning themselves as hydrogen gateways, developing bunkering infrastructure, ammonia export terminals, and energy-storage capacity to capture a share of future trade with Europe and Asia.

Infrastructure in Motion

The emerging hydrogen trade is bringing together energy producers, port authorities, and logistics operators like never before.

Saudi Arabia’s Neom Green Hydrogen Project, a joint venture with Air Products, will export all production as ammonia, which requires a purpose-built supply chain for shipping and storage. Qafco-7 in Qatar, expected to be the world’s largest blue ammonia facility by 2026, will add 1.2 million tonnes per year of capacity in Mesaieed Industrial City. Masdar’s green hydrogen programme in Abu Dhabi targets 500,000 tonnes annually, with part of it serving domestic industrial users and the rest going to export. Fertiglobe (ADNOC/OCI) recently shipped low-carbon ammonia to Japan’s Mitsui and Co for power generation, while Sabic Agri-Nutrients and Aramco have delivered similar cargoes to India, Taiwan, and Japan.

For logistics and port operators, these projects demand new terminal configurations, cryogenic handling systems, and integrated energy corridors connecting renewables, electrolysers, and maritime gateways. In effect, hydrogen is giving birth to a parallel energy logistics industry, one that mirrors oil’s global network but operates with cleaner inputs and smarter technology.

The Supply Chain Challenge

Yet the path from project pipeline to export reality is complex. Unlike oil or LNG, hydrogen presents multiple logistical bottlenecks.

First, transport remains costly and technically demanding. Hydrogen’s low energy density means it must be either compressed, liquefied at -253°C, or converted into ammonia, each process adding expense and energy loss. Pipelines exist mainly in the US and Europe, leaving MENA exporters reliant on shipping solutions.

Second, the lack of global certification and pricing standards creates uncertainty. Until governments agree on how to verify “green” hydrogen’s origins, producers have little incentive to bear higher production costs, and buyers have little guarantee of environmental credibility.

Third, storage and safety requirements differ from conventional fuels, requiring new expertise for port and logistics operators. Without clear standards, infrastructure rollout risks fragmentation across borders.

Despite these hurdles, Gulf countries are pressing ahead. Several ports, including Sohar, Duqm, and Jebel Ali, are developing dual-fuel terminals capable of handling ammonia, methanol, and conventional fuels, providing a degree of flexibility as markets evolve.

Economic and Geopolitical Implications

The hydrogen economy could reshape global trade routes in ways not seen since the oil boom.

North Africa’s proximity to Europe positions Morocco, Egypt, and Mauritania as natural suppliers for the EU’s decarbonisation goals. Pipeline connections across the Mediterranean are already under study, promising a new energy corridor from the Sahara to southern Europe.

In the Gulf, producers are deepening links with Asia’s heavy industrial consumers—Japan, South Korea, India, and China—creating eastward shipping routes for ammonia exports. This two-way pattern could transform the Red Sea, Arabian Sea, and Mediterranean into the arteries of a global hydrogen trade network.

Strategically, hydrogen gives oil exporters a way to retain their role in global energy markets while aligning with carbon-neutral pledges such as Saudi Vision 2030, Oman Vision 2040, and the UAE’s Net Zero 2050. The Energy Outlook 2025 stresses that the region’s circular carbon economy policies and carbon-capture investments are integral to this transition.

Financing and Market Readiness

For all the ambition, the hydrogen boom remains early-stage. Out of more than 130 projects across MENA, only five have reached final investment decision (FID), and another five are under construction.

The International Energy Agency (IEA) estimates that for global low-emission hydrogen to meet 2030 goals, the sector must grow at a compound rate of more than 90% annually from 2024 to 2030, faster than solar’s rise during its peak expansion years.

Investment barriers include uncertain offtake demand, fragmented regulation, and long payback horizons. Still, innovative financing models are emerging. Sovereign wealth funds such as ADQ, PIF, and OQ are co-investing in early projects. Export credit agencies in Japan and Europe are also backing long-term supply agreements. Furthermore, blended finance frameworks combining development banks and private capital are being tested to de-risk large projects in Egypt and Oman.

As the region matures, logistics players, from shipping firms to tank terminal operators, will increasingly be drawn into these investment ecosystems.

Building the Hydrogen Logistics Ecosystem

Hydrogen’s complexity creates a unique opportunity for the logistics industry to lead the energy transition.

Specialised tank-container operators, gas-carrier fleets, and storage-terminal developers are all in demand. Port authorities are redesigning master plans to include hydrogen hubs with modular storage, bunkering stations, and energy-export corridors.

In parallel, freight forwarders are carving out roles in the upstream supply chain, moving electrolysers, turbines, and renewable components across the region. Digital traceability platforms, built on blockchain, could soon verify “green molecules” from source to ship, creating a new era of transparent, accountable logistics.

As MENA economies race to export clean energy, logistics integration will define competitiveness. Those who can manage hydrogen safely, efficiently, and at scale will shape not only regional trade but also global decarbonisation pathways.

From Ambition to Acceleration

The Middle East’s hydrogen push is a chance to reimagine the region’s position in global supply chains. Hydrogen offers a bridge between its traditional strengths in energy exports and its emerging ambitions in innovation, manufacturing, and logistics.

Success will depend on whether governments, investors, and logistics operators can align to build an end-to-end hydrogen ecosystem: one that spans renewables generation, industrial offtake, port infrastructure, and international certification.

If oil built the Middle East’s global trade network, hydrogen could define its next century, a cleaner, smarter, and more connected one.