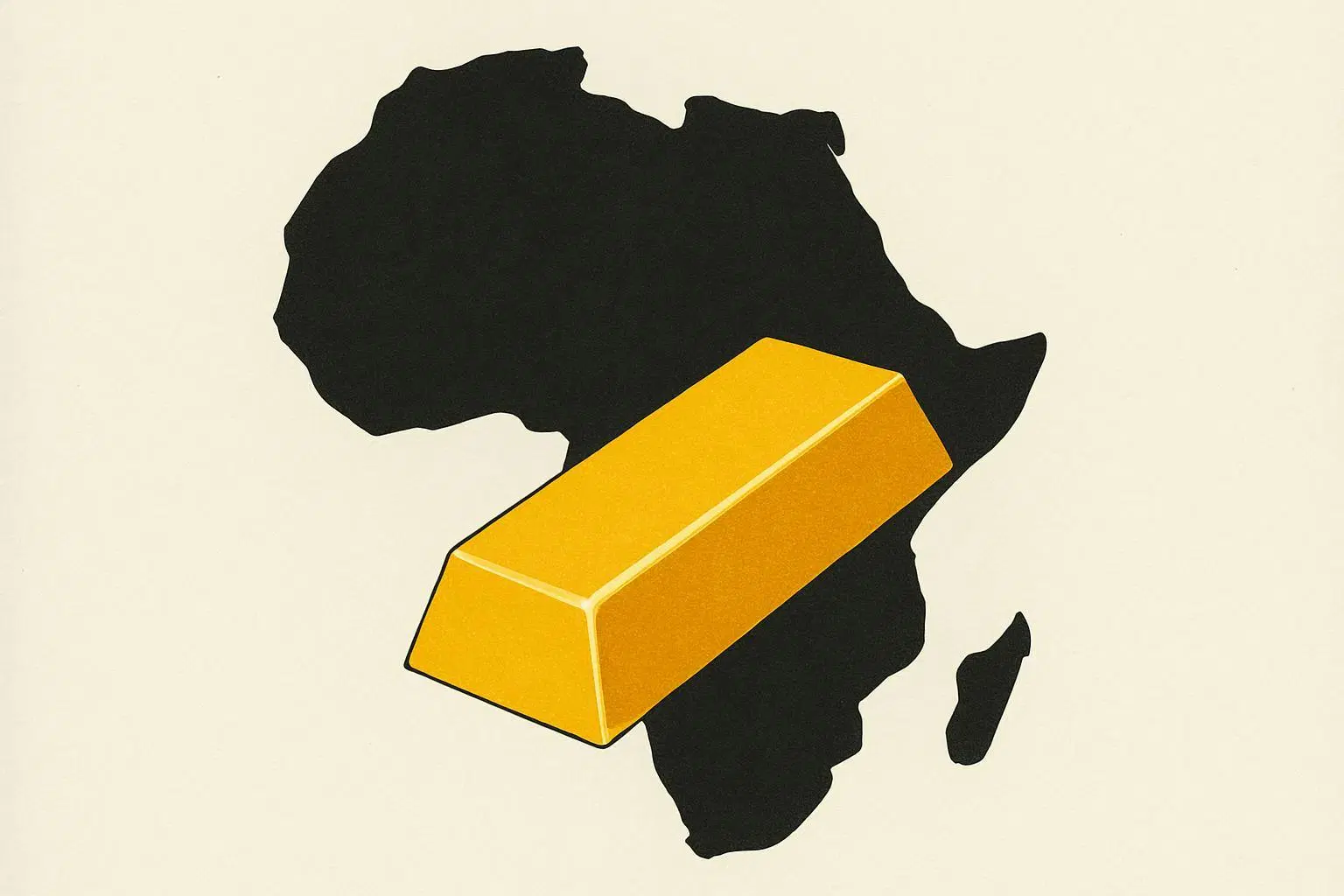

Precious Metals

Gold Shines For South Africa As Rand Gains Ground

The South African rand gained momentum this week, supported by steady gold prices and a rise in the local stock market, even as global investors adopted a cautious stance ahead of key US corporate earnings.

Key Drivers of the Rally

The currency's strength was primarily buoyed by gold's sustained rally, with the precious metal hovering near the $4,000 per ounce mark and poised for its eighth consecutive weekly gain. As a major commodity exporter, South Africa's rand often moves in tandem with gold prices.

Domestically, investor sentiment was also lifted by a successful inflation-linked bond auction and a 0.1% rise in the Johannesburg Stock Exchange's Top-40 index, which outperformed more muted global markets.

Notable Domestic Developments

The week also featured significant local events that could shape the market landscape:

- Banking Sector Scrutiny: The South African Revenue Service (SARS) launched a R4.8 billion lawsuit against bank Sasfin, a move that could have repercussions for the country's financial sector.

- Mining Policy Shift: Policymakers are advocating for chrome export quotas instead of new taxes, aiming to protect and support the local chrome processing industry.

The Bigger Picture: Commodities in Focus

The rand's performance underscores how resource trends continue to dictate the fortunes of many emerging markets. While global factors like US interest rates remain influential, South Africa's strong export earnings and evolving domestic policies are key factors for investors to watch, affecting everything from global chrome supplies to local bond markets.