Metal Markets

Exploring 3 Undiscovered Gems In The Middle East Market

As the Middle East market undergoes a period of moderation, with UAE stocks easing amid declining oil prices and profit-taking, investors are monitoring broader economic indicators that could influence small-cap companies. In this climate, identifying promising stocks involves seeking those with robust fundamentals and growth potential despite prevailing market headwinds.

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Qassim Cement | NA | 4.02% | -11.40% | ★★★★★★ |

| Saudi Azm for Communication and Information Technology | 3.26% | 17.17% | 23.30% | ★★★★★★ |

| Najran Cement | 14.49% | -4.20% | -30.16% | ★★★★★★ |

| Mackolik Internet Hizmetleri Ticaret | 14.04% | 29.58% | 34.64% | ★★★★★☆ |

| Sönmez Filament Sentetik Iplik ve Elyaf Sanayi | NA | 54.80% | 42.62% | ★★★★★☆ |

| Gür-Sel Turizm Tasimacilik ve Servis Ticaret | 4.69% | 36.04% | 53.41% | ★★★★★☆ |

| Birikim Varlik Yonetim Anonim Sirketi | 59.38% | 42.42% | 36.01% | ★★★★☆☆ |

| Bosch Fren Sistemleri Sanayi ve Ticaret | 36.11% | 41.59% | 7.72% | ★★★★☆☆ |

| Blume Metal Kimya Anonim Sirketi | 4.78% | 36.99% | 42.99% | ★★★★☆☆ |

| Marmaris Altinyunus Turistik Tesisler | NA | 47.16% | -34.78% | ★★★★☆☆ |

The accompanying screener highlights a selection of undiscovered gems with strong fundamentals in the region. The table presents key metrics for ten such companies, including Debt to Equity ratios, Revenue Growth, Earnings Growth, and a proprietary Health Rating.

A detailed examination of several selections from the screener follows.

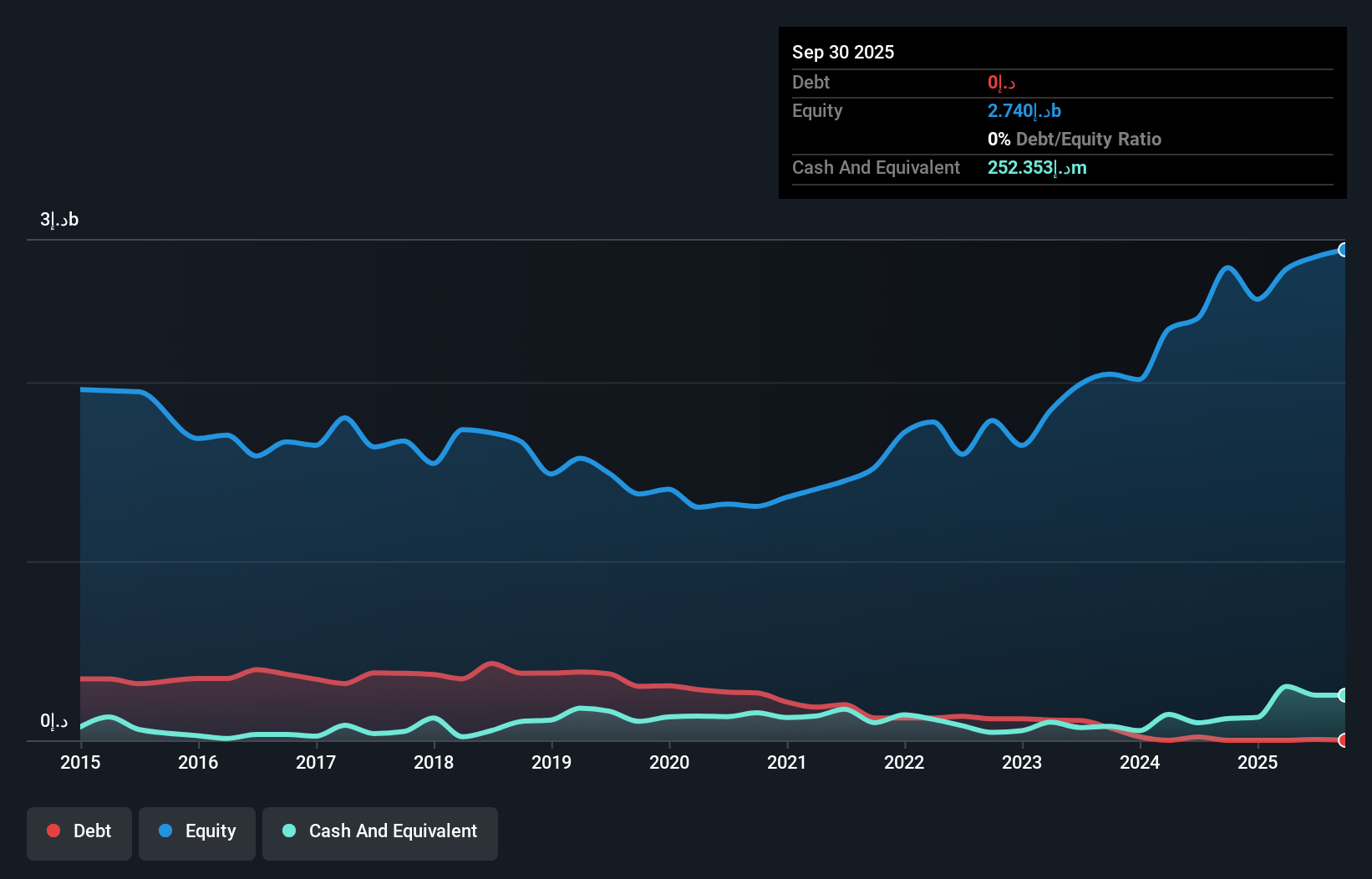

National Cement Company (Public Shareholding) (DFM:NCC), with a market capitalization of AED 1.54 billion, operates in the cement production and distribution sector. The company demonstrates promising financial health, having eliminated its debt over the past five years. Its earnings have grown at an annual rate of 47% over that period, though recent growth of 23.5% trails the industry average. Trading at an estimated 31% below fair value, the stock appears potentially undervalued. Recent operational performance remains solid, with third-quarter sales reaching AED 65 million and net income doubling year-over-year to AED 14 million.

Al Masane Al Kobra Mining (SASE:1322), a Saudi mining company with a market cap of SAR 7.46 billion, has shown remarkable growth. Its earnings surged 75.9% over the past year, significantly outpacing its industry. The company has also dramatically strengthened its balance sheet, reducing its debt-to-equity ratio from 75.1% to 2.9% over five years. Recent mineral discoveries in Najran and a quarterly sales increase to SAR 271 million underscore its promising trajectory and resource potential.

Al Rajhi REIT Fund (SASE:4340), a Sharia-compliant real estate investment fund with a market cap of SAR 2.23 billion, has exhibited financial resilience. Its earnings grew 30.6% over the past year, contrasting with a sector-wide decline. The fund has also improved its debt management, lowering its debt-to-equity ratio from 51.8% to 39.9% over five years. With a price-to-earnings ratio of 11.9x, below the Saudi market average, and a recent dividend distribution, it presents a profile of value and income.

Interested parties can reveal all 185 companies identified by the Middle Eastern Undiscovered Gems With Strong Fundamentals screener. Investors currently holding these stocks may consider monitoring developments through a dedicated portfolio tool.