Energy

Hydropower poised to drive Africa’s clean energy future – IHA report

Hydropower, with 43.5 GW of installed conventional capacity in Africa, is becoming increasingly important for the continent's development, supported by large national projects as well as smaller private-sector initiatives.

What: Africa’s vast hydropower resources remain largely underdeveloped, with only about 11% of its technical potential harnessed.

Why: Progress is slow compared with potential. Financing challenges, governance concerns and slow permitting continue to delay delivery.

What next: The challenge now lies in modernising existing assets and securing the finance needed to bring the continent’s huge pipeline of projects to fruition.

Africa holds some of the world’s richest hydropower resources, yet its vast potential remains largely untapped. According to the International Hydropower Association’s (IHA) 2025 World Hydropower Outlook, the continent has only harnessed about 11% of its technical potential, despite hydropower already contributing around 20% of Africa’s total electricity generation.

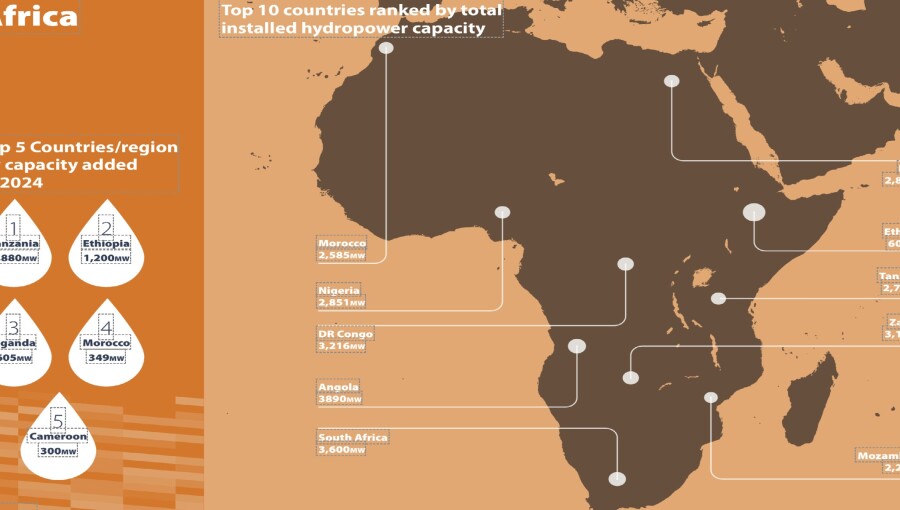

With an installed base of 43.5 GW of conventional capacity, hydropower plays a growing role in the continent’s development, but progress has been uneven, hampered by financing challenges and structural barriers. Africa’s total installed hydropower capacity, including pumped hydro, is 47 GW, according to the report.

The breakthrough

The IHA report notes that 2024 was a breakthrough year, with more than 4.5 GW of new hydropower capacity added in Africa – double the 2 GW commissioned in 2023.

Several major projects reached key milestones. Tanzania’s Julius Nyerere dam brought six of its nine 235-MW units online. In Ethiopia, the $5bn Grand Renaissance Dam (GERD) added another 800 MW with its third and fourth turbines. Uganda’s 600-MW Karuma and Cameroon’s 420-MW Nachtigal plants were also fully commissioned.

These achievements mark a significant step forward in Africa’s clean energy transition, demonstrating that large-scale hydropower can move from planning to delivery despite persistent obstacles.

Yet the starting point remains low. While hydropower already accounts for a fifth of Africa’s electricity generation, this is derived from just a fraction of the continent’s more than 600-GW technical potential. The Outlook highlights a massive pipeline of stalled projects – 18.5 GW of approved capacity awaiting finance and construction, and another 63.4 GW yet to be approved.

This pool alone represents 42% of global projects currently seeking approval. If built, the projects could generate 250–300 TWh annually, equivalent to more than a third of Africa’s current electricity demand. Unlocking this pipeline, the IHA stresses, will be essential for universal energy access and for Africa’s role in the global clean energy transition.

Untapped potential

Much of this untapped potential is concentrated in the Democratic Republic of Congo’s Grand Inga scheme, a project of gigantic scale that could deliver close to 50 GW of capacity. However, it continues to face daunting challenges: financing constraints, governance risks, and opposition from local communities. Despite this, the World Bank has signalled renewed interest in the DRC project, beginning with an Inga III phase that could deliver between 3 GW and 11 GW.

Whether this long-delayed scheme advances or not, smaller projects across Africa are proving more accessible to private developers and offer a pathway to faster progress. In countries such as Burundi, Côte d’Ivoire and Eswatini, smaller-scale hydropower projects are taking root. Supported by the International Finance Corporation (IFC) and other development partners, new models are being piloted to attract private-sector participation.

One approach is to pre-develop concessions and then auction them to private delivery partners, streamlining the process and reducing costly delays linked to redesigns and renegotiations. This model, if scaled, could unlock a new wave of privately financed projects, providing reliable electricity to regions where access remains limited.

Modernisation of existing plants is also a priority. Many of Africa’s older hydropower stations require upgrades to operate efficiently and extend their lifespan. To that end, the African Development Bank (AfDB) has launched the Africa Hydropower Modernisation Programme with an initial budget of $9.72mn. The programme will target 12 privately led projects across eight countries.

IHA assessments identified 4.6 GW in urgent need of modernisation and a further 10.1 GW requiring medium-level intervention. Upgrades could bring 0.8 GW of currently idle units back into service and increase available capacity by up to 1.6 GW, securing output from assets already in place.

Sustainability is also moving up the agenda. In 2024, Zambia’s 180-MW Ngonye Falls Hydroelectric Project became the first in Africa to receive gold certification under the Hydropower Sustainability Standard (HSS), setting a precedent for others to follow. By embedding international good practice in design, construction and operation, such certification can help improve investor confidence and align African projects with global environmental and social benchmarks.

The Abuja Action Plan

Despite the encouraging progress, the sector continues to face structural barriers. Many projects stall before reaching final investment decision (FID) because of concerns over offtake risk, high foreign exchange hedging costs and lender apprehension about bankability.

To address these issues, the IHA and its partners in 2024 launched the Abuja Action Plan (AAP), which sets out recommendations to de-risk projects and attract finance. It calls on governments to recognise hydropower as a clean, reliable and affordable energy source, and to integrate it into long-term renewable energy strategies. It also urges governments to speed up permitting, while improving the quality of decision-making, and to ensure transmission infrastructure is in place to absorb new capacity.

The AAP also appeals to international financial institutions and sustainable development funds to increase support for renewable energy infrastructure. Developers are encouraged to adopt the HSS as a benchmark, with governments committing to expediting projects that meet its criteria. By creating a more predictable, transparent and supportive investment environment, the AAP aims to unlock the tens of gigawatts of hydropower capacity now stuck in limbo.

Building momentum

Africa’s hydropower journey is only beginning. With just over 10% of its technical potential developed, the sector has the scale to transform energy access and underpin economic growth across the continent.

The progress achieved in 2024 demonstrates that momentum is building, driven by both flagship national projects and smaller private-sector initiatives. The challenge now lies in accelerating this trend, modernising existing assets, and securing the finance needed to bring the continent’s huge pipeline of projects to fruition. If these barriers can be overcome, hydropower will not only play a central role in Africa’s energy future but also ensure the continent makes a decisive contribution to the global transition to clean energy.