Mining Other

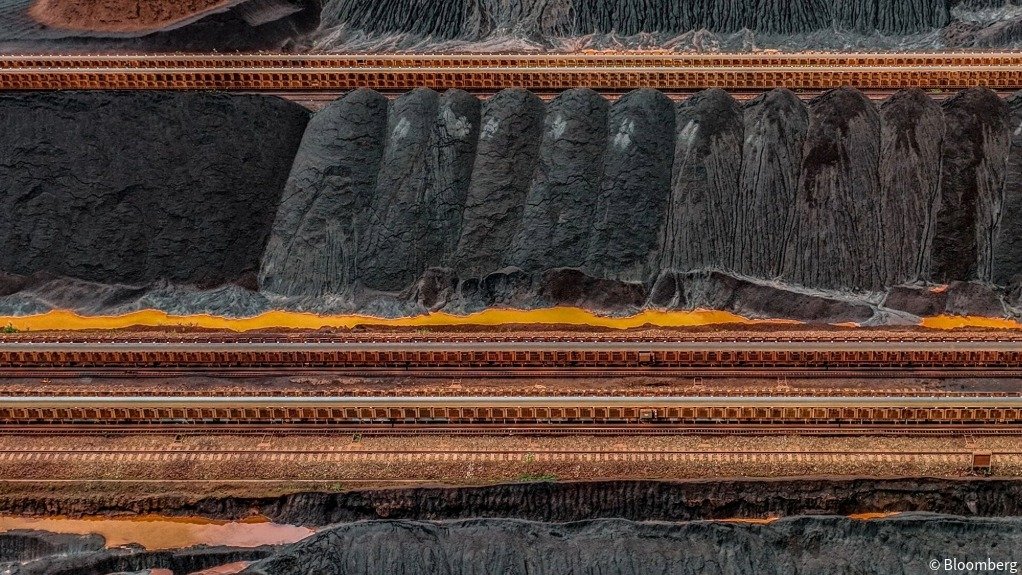

Iron-ore hits over one-week high as Rio Tinto suspends work at Guinea mine

The most-traded January iron ore contract on China's Dalian Commodity Exchange (DCE) DCIOcv1 closed daytime trade 2.27% higher at 787 yuan ($110.06) a metric ton, its highest since August 14.

The benchmark September iron ore SZZFU5 on the Singapore Exchange rose 2.69% to $103.3 a ton, as of 0810 GMT, the highest since August 14.

Rio Tinto RIO.L, the world's largest iron ore miner, said on Saturday it had suspended activities at Guinea's SimFer mine site after an incident there left a contract worker dead.

The miner, which owns two of the four Simandou mining blocks as part of its SimFer joint venture with China's Chalco Iron Ore Holdings (CIOH) and the Guinea government, had earlier expected the first iron ore shipment in November.

Rio Tinto did not respond to a Reuters request for comment.

Supporting prices of the key steelmaking ingredient, near-term demand remained firm despite production restrictions on mills in top Chinese steelmaking hub Tangshan to ensure clean air in Beijing ahead of a military parade to commemorate the end of World War Two.

Average daily hot metal output, a gauge of iron ore demand, held steady at 2.41 million tons in the week to August 21, data from consultancy Mysteel showed.

Shanghai's announcement to relax home buying restrictions for eligible families also boosted sentiment.

Coking coal DJMcv1 and coke DCJcv1, other steelmaking ingredients, rallied 6.48% and 4.36%, respectively.

"A recent mine accident sparked expectations of more stringent safety checks that might reduce supply, underpinning coal prices," a Shanghai-based coal analyst said on condition of anonymity as he is not authorised to speak to the media.

Steel benchmarks on the Shanghai Futures Exchange advanced on higher raw materials costs.

Rebar SRBcv1 gained 0.71%, hot-rolled coil SHHCcv1 rose 0.92%, wire rod SWRcv1 climbed 0.65% and stainless steel SHSScv1 added 0.98%.