Base Metals

Celsius Sells Opuwo Cobalt Project, Takes Major Write-Down

Australian-listed company Celsius Resources has reduced the value of its Opuwo Cobalt Project in northwest Namibia by approximately N$75 million, citing ongoing market difficulties and uncertainty around how long it would take to develop the site. The decision was outlined in Celsius’s June 2025 quarterly report and reflects broader struggles in the cobalt sector, where junior miners are feeling the pressure from low prices and tighter access to funding.

As part of a broader shift in strategy, Celsius has also agreed to sell all its Namibian assets, including the Opuwo Cobalt Project. The buyer is an unnamed international group. This transaction, announced in late July, means Celsius will be exiting the Namibian mining sector entirely. The new owners are expected to take on the full responsibility for developing the project, including meeting environmental, regulatory and community-related obligations.

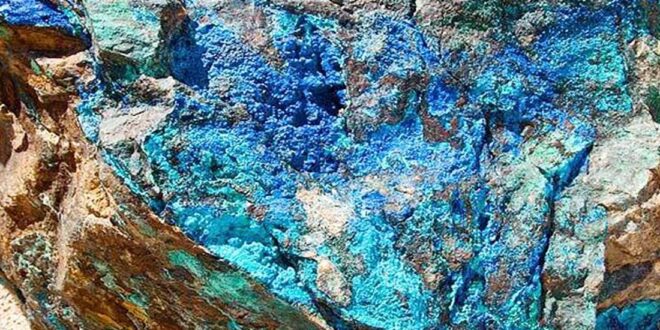

The Opuwo project, located near the town of Opuwo in the Kunene Region, is considered one of the largest undeveloped primary cobalt resources in Africa outside the Democratic Republic of Congo. It holds an estimated 225.5 million tonnes of ore, containing cobalt, copper and zinc, and includes more than 260 000 tonnes of cobalt. Its shallow, sediment-hosted design makes it suitable for open-pit mining. Unlike many cobalt sites in the DRC, Opuwo is a standalone cobalt resource, not dependent on the byproducts of copper or platinum mining.

Globally, the cobalt market is dominated by the DRC, which supplies over 70% of the world’s cobalt through massive mines such as Tenke Fungurume, Mutanda and Kamoa-Kakula. However, growing concerns about governance, human rights, and supply chain transparency in the region have driven interest in more stable alternatives. Namibia, with its predictable permitting processes, stable political environment and strong infrastructure, is increasingly seen as one such alternative.

While Zambia and Morocco also produce cobalt, their operations are largely secondary. South Africa recovers small amounts of cobalt, mostly from platinum mines. Opuwo remains one of the few major primary cobalt plays on the continent, potentially second only to the major sites in the DRC.

On a global level, the Opuwo project ranks alongside other promising but still-developing cobalt sites like Jervois Global’s Idaho Cobalt Operations in the US and Giga Metals’ Turnagain project in Canada. Like its international peers, Opuwo is still working through stages such as feasibility studies and testwork. A preliminary scoping study and several metallurgical tests have already been completed, but Celsius had previously stated that more work was needed before reaching full feasibility.

The decision to sell may have been influenced by the rising costs of long-term development and an increasingly competitive and unpredictable cobalt market. Namibia’s plan to raise local ownership of mining projects from 51% to 60% by 2030 could also have factored in. This change, outlined under the government’s sixth National Development Plan, is part of a wider move to increase national participation and benefits in resource extraction.

Celsius’s decision to write down the value of the Opuwo Cobalt Project and to exit the country reflects the current volatility faced by small and mid-sized players in the cobalt space. Even so, the project remains a significant asset with long-term potential, particularly for buyers who are prepared to take on the risks and opportunities that come with early-stage mining ventures in a shifting global market.