Mining Other

Akobo records strong January performance

In an operational update for the month, the company highlights that it is benefiting from historically high gold prices, which have a clear and positive impact on cash flow and financial capacity.

Higher gold prices increase the revenue per ounce produced, while Akobo’s cost base remains largely unchanged in the short term, resulting in stronger operating margins and improved free cash flow.

The company’s gold loan is not affected in any way that changes its structure, repayment profile or underlying economics, it points out.

As the loan is repaid in ounces, the key determinant of repayment remains production performance.

The gold loan, amounting to about 9 500 oz, represents a limited share of Akobo’s about 69 000 oz mineral resource, and higher gold prices further enhance cash flow and repayment capacity within the agreed timeframe to mid-2027, the company explains.

The current development plan, including the decision to sink the shaft to its final depth in one continuous phase, does not trigger any need for amendments to the loan agreement, it adds.

A successful site visit was conducted during the period with Akobo Minerals’ chairperson and a senior representative from Monetary Metals, the company highlights.

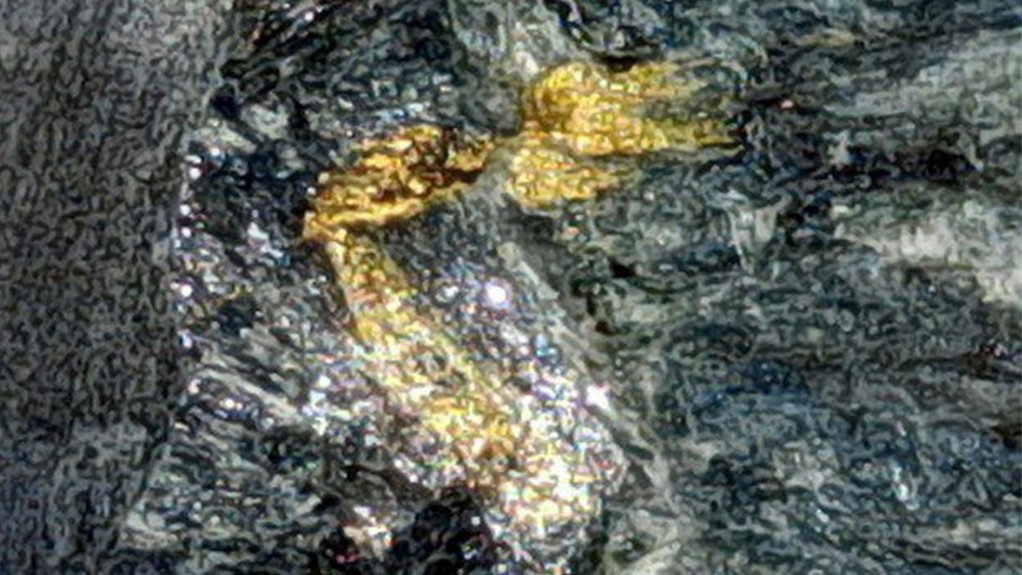

About 8 kg of gold was produced in the month.

Cumulative doré production to date is about 81 kg, while stock of blended material available for processing is about 500 t with an estimated in-situ value of $1.6-million at current gold price levels.

Operations at the Segele mine remained stable throughout January, with continued production from existing underground workings alongside ongoing development activities targeting new high-grade areas within the mine.

The current depth of the eastern winze is about 84 m, while the western winze has reached about 65 m.

The current stock of blended material provides operational flexibility, ensuring stable throughput and consistent gold recovery, Akobo points out.

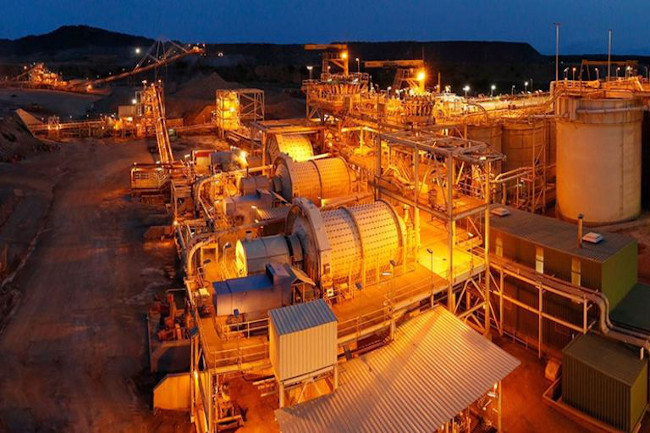

It highlights that the processing plant is currently operating without capacity constraints, running in batch mode towards the end of each month.

Once the new vertical shaft is fully operational, the plant is expected to transition to continuous 24/7 operation to handle higher and more consistent tonnage.

In terms of vertical shaft development, the foundation for the headgear is in its final stage; installation of the temporary winch and headgear is ongoing; the main headgear is in transit to site; conveyance equipment for underground operations, including rails and ore buggies, is in preparation for shipping; and the shaft sinking team is back on site and prepared to resume sinking, with about 80 m remaining to the final level.